Last year, Bitcoin and blockchain assets in general saw huge returns. The collective value of all the traded blockchain assets went from $17 billion to a staggering $600 billion just before the year’s end, representing a 3500% increase. Bitcoin went from $1,000 and to $13,000, a return of 1,300%.

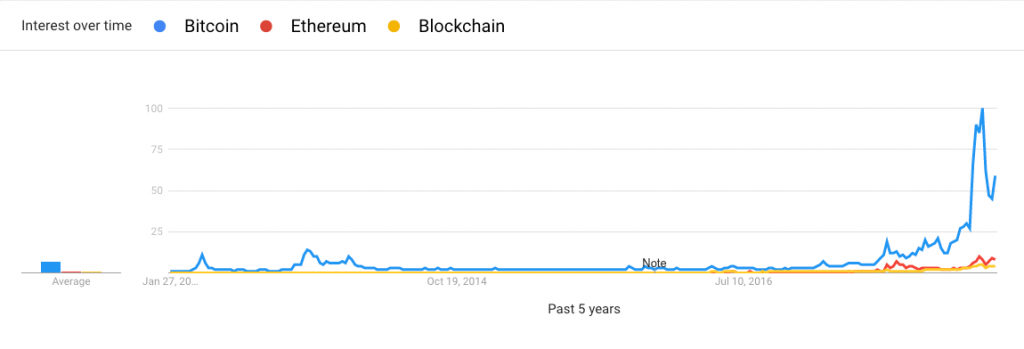

Bitcoin and other cryptocurrencies such as Ethereum, NEO and Dash entered the mainstream, spreading over social media and through extensive coverage by many established media outlets such as CNBC, Bloomberg and Forbes. Google Trends illustrates the public hunger for more information on the hot topic of the year, seeing a huge sipke just before Christmas.

2017 was also the year in which we saw the first clear signs of institutional adoption, as big banks decided they weren’t going to just stay on the sidelines anymore. CME and CBOE both launched exchange traded Bitcoin futures at the end of the year, a highly anticipated event, sending the price for a single Bitcoin to $20,000.

Naturally, such explosive growth is followed by uncertainty and scepticism. This is a healthy intuition, but is it the right attitude for this new year? No one knows for sure what 2018 will bring to the table, however there is a case to be made that this year could even put 2017 to shame.

Bitcoin and blockchain assets in general went into a two year long bear phase after the peak at the end of 2013. This phase is critical to rationalise the current market. 2014 and 2015 where the years of governments auctioning off huge piles of bitcoins and over the counter trades represented the majority of the market liquidity.

This OTC liquidity pool dried up eventually and we saw the start of today’s bull market. Demand was no longer covered by the off-exchange markets and so big investors saw themselves forced to buy on the public exchanges, where the price is set. Underestimating this two year long accumulation phase leads to the danger of turning bearish too early. The only way to satisfy current demand is by increasing liquidity through an increase of the market capitalisation, meaning a higher Bitcoin price.

An added difficulty is that there is no reference for determining the fair value of a blockchain asset. The whole class is in a price discovery mode and any figures are at best an approximation. As long as demand keeps growing and the adoption keeps expanding, it’s fair to assume prices will continue to rise.

This year, we could also see the biggest adoption wave yet. A first cryptocurrency ETF is a highly anticipated event and the most likely candidate to be initially listed is Bitcoin. However, similar applications for Ethereum and other blockchain assets have submitted to the SEC, awaiting a response.

On the 17th January 2018, two blockchain-oriented ETFs went live. Amplify Investments and Reality Shares Inc both list similar products and invest into companies which show an effort to develop and integrate blockchain technology. Ticker BLOK and BLCN.

This piece solely expresses the opinion of the author and not necessarily the organization as a whole. Students For Liberty is committed to facilitating a broad dialogue for liberty, representing a variety of opinions. If you’re a student interested in presenting your perspective on this blog, click here to submit a guest post!